Schools & Communities First FAQs

Closing the Corporate Loophole

Frequently Asked Questions

What is the Schools and Communities First ballot measure?

Schools and Communities First is a state-wide initiative that will appear on the November 2020 ballot. It will reclaim $12 billion a year for California’s schools and communities by taxing large commercial properties at fair market value.

Will it affect homeowners?

This initiative will NOT change Prop. 13 for any residential property.

What about apartments?

Apartments will not be affected either, nor residential renters of any kind. In mixed-use buildings, only the commercial part of the property will be reassessed at fair market value.

What about other residential properties?

In addition to single family homes and apartment buildings, SCF also exempts mobile homes, assisted living facilities, vacation homes, Airbnb, live/work spaces, and home businesses.

What about farms?

This initiative exempts all agricultural land.

What about small businesses?

All small business properties with a market value of $3 million or less shall be exempted from reassessment. If 50% or more of the square footage of a commercial/industrial property is occupied by small businesses (see definition below), the reassessment will be delayed until the 2025-26 fiscal year, or later if authorized by the Legislature. In addition, small businesses will be provided with direct tax relief through elimination of the tax on business equipment. This is a tax break worth $1 billion a year.

What is the definition of a small business?

50 or fewer FTE employees in the state

The business is independently owned and operated

The business is located in California

Won't this be bad for business in California?

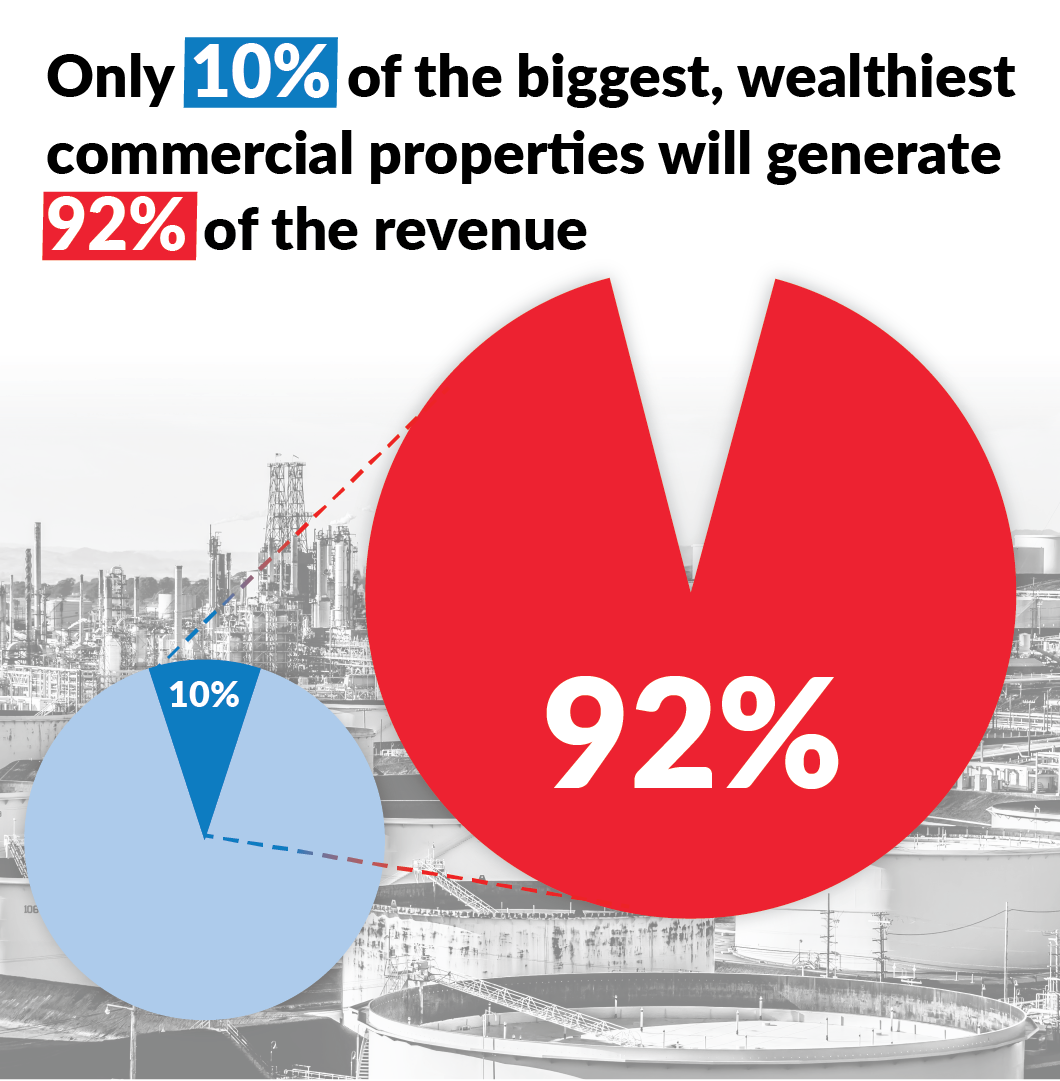

No. The Corporate Tax Loophole doesn’t incentivize creating jobs or economic activity – it incentivizes land owners holding on to property for decades without doing anything productive with it. In fact, only 10% of commercial properties get nearly 92% of the tax savings from this Corporate Loophole. Under the current system, two identical businesses side-by-side may pay drastically different property taxes. This penalizes new businesses by making them subsidize their established competitors’ property tax. By leveling the playing field and bringing a minority of older commercial properties up to fair market property tax rates, we will be creating a healthier and more competitive business climate.

Won't this cause businesses to leave California?

No. We are the only state in the country that does not regularly reassess commercial property. Most states actually tax their commercial property at a higher percentage than residential property. Texas, for instance, taxes their commercial property at 2.5% of fair market value. Our property tax rate will remain capped at 1%.

Won't businesses just pass the cost for goods and services down to consumers? Won't rents go up?

No. Large commercial property owners don’t share their Corporate Loophole savings with consumers. Prices for goods and services are based on the market, not on the property taxes a business pays. Have you ever received a corporate loophole discount from a gas station, store or for office space? The answer is no.

Throughout California there are examples of gas stations across the street from one another charging the same price for gas, despite one gas station paying ten times less in property taxes. The only thing California consumers get from the Corporate Tax Loophole are underfunded schools and community services as well as higher taxes and fees.

Will this reassessment for commercial property happen all at once?

No, this reform will be gradually phased in over time starting with the oldest properties first. This measure provides for compensation from revenues generated by the measure of administrative costs, including costs of the Assessors Offices, to implement the new system. It also directs the Legislature to consult with Assessors to develop a phase- in approach that begins in the 2022-23 fiscal year and extends over 2 or more years, allowing for reasonable workload, including an expedited process for hearing appeals. The phase-in period also applies to property owners who shall have a reasonable timeframe within which to pay any increase in taxes. After the initial reassessment is completed, all commercial and industrial property shall be periodically reassessed no less frequently than every 3 years as determined by the Legislature.

Aren't there other loopholes that corporations exploit to avoid paying property tax?

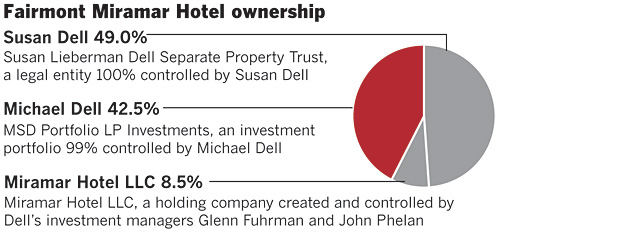

Yes. Currently, commercial property owners can split up the purchase of a property amongst several parties in order to keep all ownership shares under 50%. By ensuring that no one entity owns more than 50% of a property, no property tax reassessment is triggered. One famous example is Michael Dell, the founder of Dell computers, who bought a hotel in Santa Monica for $200 million but was able to save a million a year in property taxes by splitting up the purchase between multiple people. By instituting regular reassessment of large commercial property, these tax evasions will no longer be possible because reassessment will occur every year regardless of the circumstances of the purchase.

Where will the new revenue from this reform go?

This will be local money that will stay local, and will not go to Sacramento. This is revenue that will fund our local schools, cities, counties, and special districts for services that we all rely on like health clinics, parks and roads.

In the 1970s, California was tied with New York for 5th in the nation in per-pupil education funding. Today New York spends twice what we do for education and we have the most crowded classrooms in the country. 40% of this revenue will go directly to our public schools.

The rest will go to our local governments that currently have no other choice than to levy regressive taxes and fees on individuals and small businesses just to make ends meet. Closing the Corporate Tax Loophole is the only way to restore over $12 billion a year to our schools and community services without increasing taxes on homeowners or renters.