Our Plan

Here's our plan to make California’s property tax system work for the people, NOT corporations.

Establish regular reassessment of non-residential, commercial property in California. No other state in the country has frozen commercial property tax rates. Most states reassess commercial property every 1-5 years.

Maintain current property tax protections for all residential property. Homeowners, home renters, apartment owners, and apartment renters will not be affected by this reform.

Provide relief for small businesses. Small business owners will be exempt from this reform and also provided with direct tax relief through elimination of the business personal property tax.

Implement this reform in a smart way. Some commercial properties have not been reassessed in 40 years, meaning their owners are still paying property rates based on 1970s assessments. Our proposal will gradually phase-in changes to tax rates. Upon implementation, it will take three years until non-residential, commercial property owners will be paying taxes based on their current market value.

This commonsense reform will:

Decrease the tax burden on working families. Because a small number of commercial property owners don’t pay their fair share, everyone else in California pays more. Only 6% of commercial properties get nearly 80% of the money from the Corporate Tax Loophole - but it costs our local schools and community services over $12 billion a year. This has resulted in higher income, sales, and local taxes for everyone else. Closing this loophole is the only fair way to restore billions in funding for our local schools and communities without raising taxes on homeowners or renters.

Provide over $12 billion a year of desperately needed revenue to our schools and public services. Prior to 1978, California schools ranked in the top ten nationally in per pupil spending, today we are in the bottom ten! Meanwhile, we have the most overcrowded classrooms in the country. Restoring funding to our schools is critical for the future of California and making corporations pay their fair share is the best way to do this.

Increase California's fiscal stability. Increased reliance on more volatile forms of taxation, like income and sales tax is bad for our economy. The property tax is the most stable form of taxation, which is why it should be a greater source of revenue for county and municipal governments.

Make California's property tax system fairer. In most counties, the property tax burden was equally shared 40 years ago. Since then, the property tax burden in California has dramatically shifted from commercial property to residential property. Today, homeowners pay 72% of property taxes, while commercial properties only pay 28%.

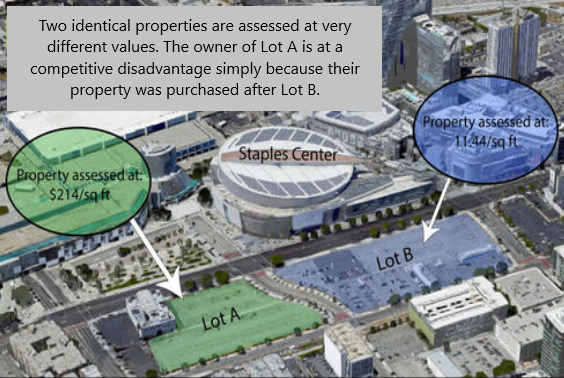

Stop penalizing new businesses by leveling the playing field. Only 6% of commercial properties get nearly 80% of the tax savings from this loophole. It is anti-competitive to tax two identical properties at vastly different amounts. Taxing all commercial properties at their fair market value will restore billions in revenue for education and infrastructure improvements needed to grow our economy. Closing the Corporate Tax Loophole is needed for California to remain a leader in technology and innovation.

Please note that these lots are currently undergoing redevelopment as of March 2018.