Schools & Local Communities Funding Act

Reclaims Over $12 Billion a Year for our Schools and Public Services

This historic initiative will:

Reclaim $12 billion a year for schools and communities.

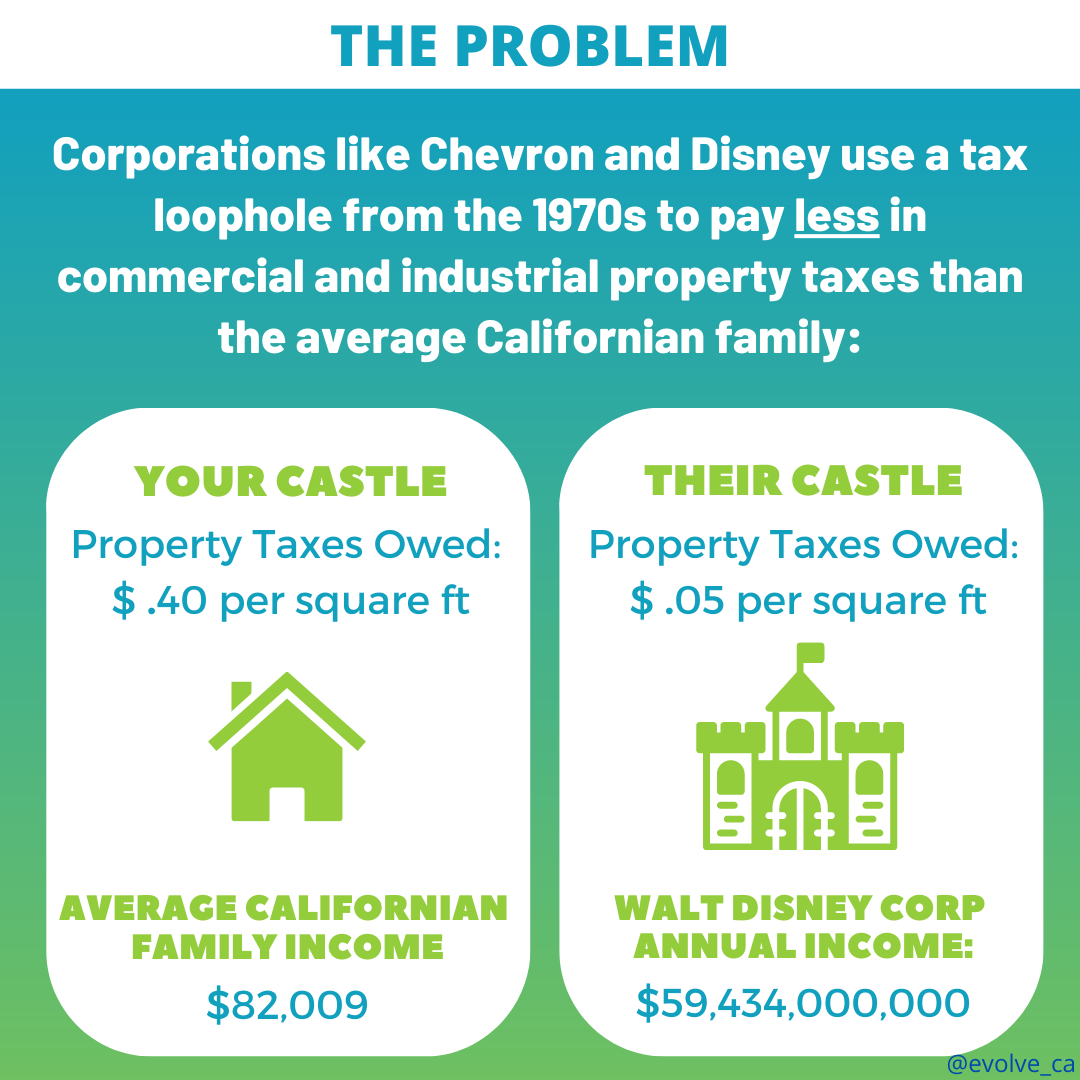

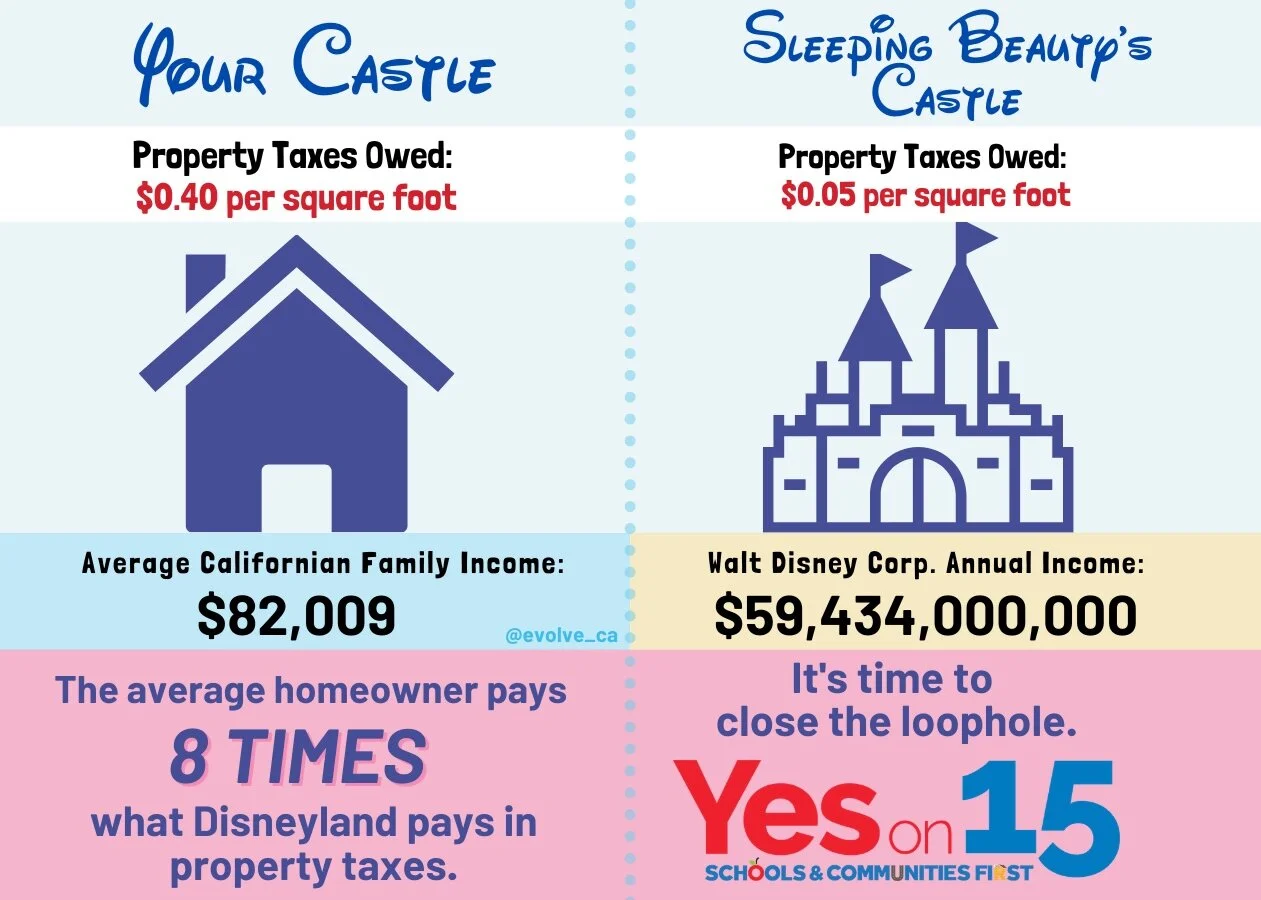

Close property tax loopholes so large corporations, like Disney and Chevron, pay taxes at fair market value.

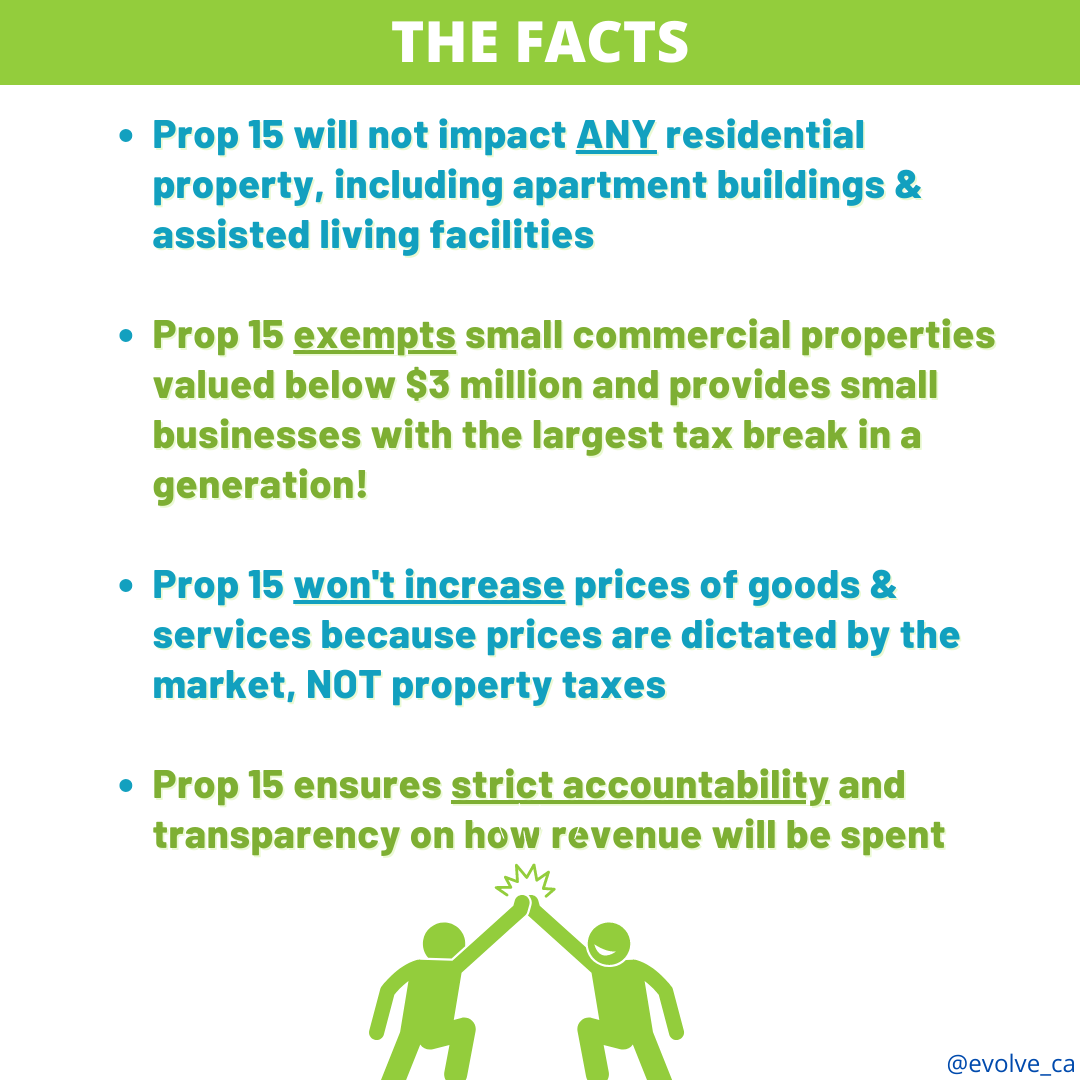

NOT raise taxes on homeowners or renters.

Mandate full transparency and accountability for all revenue restored to California’s schools and local communities.

California’s tax bill is a massive tax giveaway to large corporations paid for by raising taxes on Californians and slashing funding for our schools and vital community services. In California we have our own massive tax giveaway that benefits these same large corporations at the expense of homeowners, renters and small businesses.

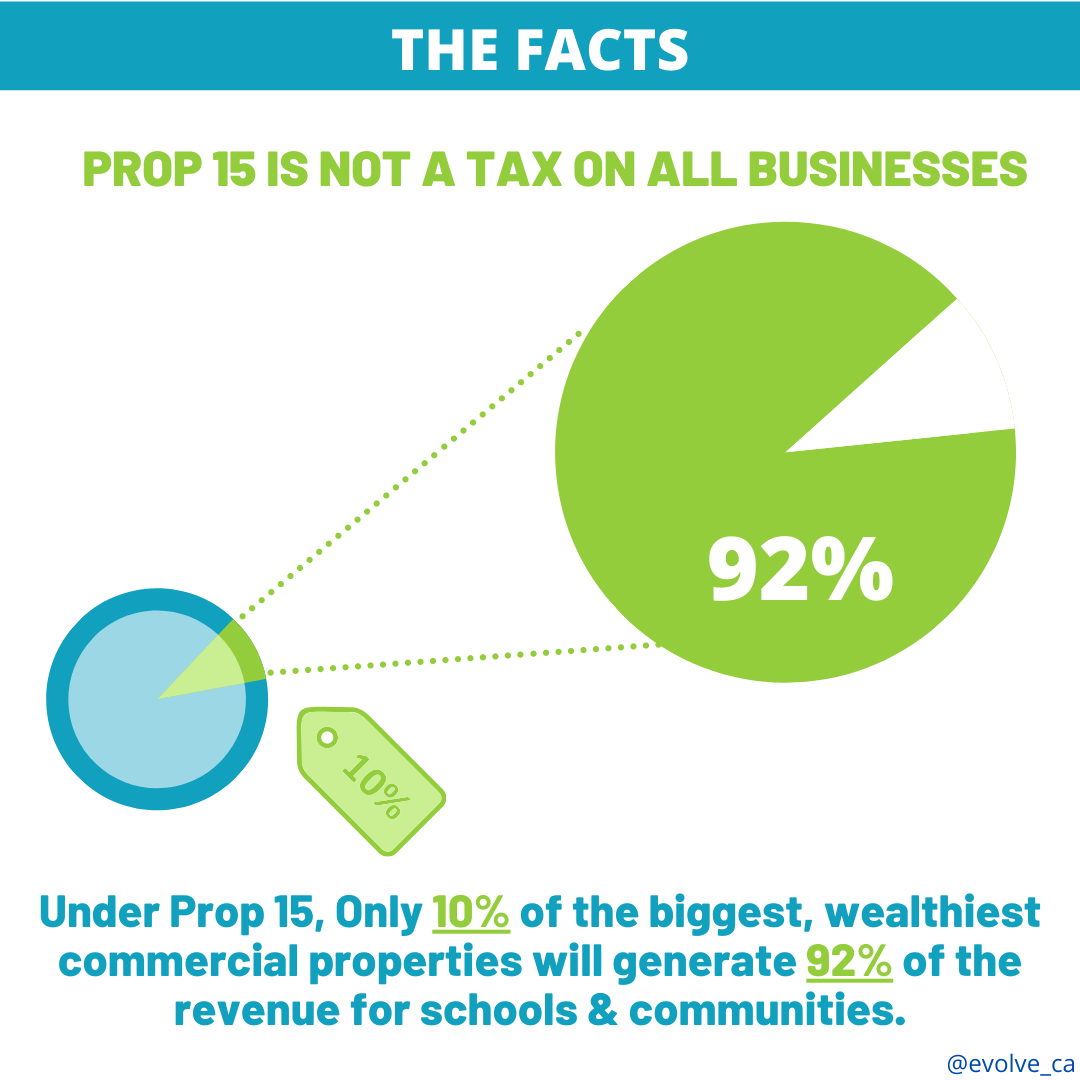

The Corporate property tax Loophole allows a small number of large commercial property owners to avoid paying over $12 billion every year in property taxes. In fact, only 6% of commercial properties get 77% of the benefit from this loophole.

California schools and communities have suffered for over 40 years of disinvestment due to the Corporate Loophole. It’s time to close this loophole and make large commercial property owners pay their fair share. This will restore vital funding for schools and community colleges, parks, filling potholes, firefighters and first responders, affordable housing and homeless services, libraries, public transportation and health clinics.

Schools and Communities First is the only fair way to reclaim $12 billion of reliable revenue every year for our schools and local communities without raising taxes on homeowners, renters, or small businesses.

Join a growing statewide coalition of community groups, educators, parents, local community leaders and organizations that are supporting this commonsense and desperately needed reform.

You can read the language of the ballot initiative here.